Sending out your first invoice is one of the most exciting milestones in your business! You get to see your hard work literally paying off. If you’ve never done an invoice before, you might be wondering how to tackle it. Read this article to know where to start.

What is an invoice?

An invoice is a notice of due payment. It’s the document you send to your client so that they can pay you for your services. An invoice will include details of the work completed, how much you are charging for the service, and where the payee will make the payment.

How do I write an invoice?

It’s very simple to write an invoice, and even easier if you use a template. You can find templates online, or have a look at our example invoice (Word document).

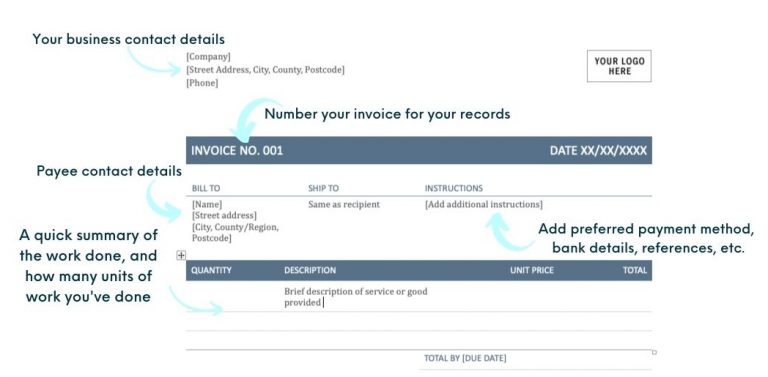

Here’s what you should include in an invoice:

- Business name, address and contact details

- Date of invoice

- Address of recipient

- Instructions: payment method, bank details, reference name, etc.

- Brief description of work completed

- Cost of service and total amount (including VAT if you are VAT registered)

- Payment due date (e.g. 7 days or 30 days)

- How to keep your invoices in order

How to keep your invoices in order

The best way to keep track of your invoices is to keep a master spreadsheet where each invoice is stored. By numbering every invoice, you can see exactly what it is for, what date it was sent to a recipient and what date it was paid. Have a look at our example invoice master spreadsheet (Excel).

Remember, invoices are important for your business as it’s one of the key ways you can get paid. Don’t be afraid to chase clients who are late in paying you – you’ve done the work, you need to be paid for it!

Other resources:

There are loads of great resources out there to assist you with your invoices. Here are just some of them…

Read this article for help on how to set up your business bank account